Walz Proposes Tax Hikes on the Rich to Balance State Budget

MINNEAPOLIS (AP/FOX9) — Gov. Tim Walz proposed raising taxes on the wealthiest Minnesotans and large companies Tuesday to help plug a projected $1.28 billion gap in the next two-year budget while increasing spending on education and on helping the state recover from the coronavirus pandemic.

The Democratic governor’s budget proposal includes new spending of $745 million on education through 12th grade, in addition to recent federal aid of $649 million for helping schools bounce back from the pandemic.

Walz also proposes spending $50 million on a new small business forgivable loan program to help the hardest-hit businesses sustain their operations and emerge from the pandemic.

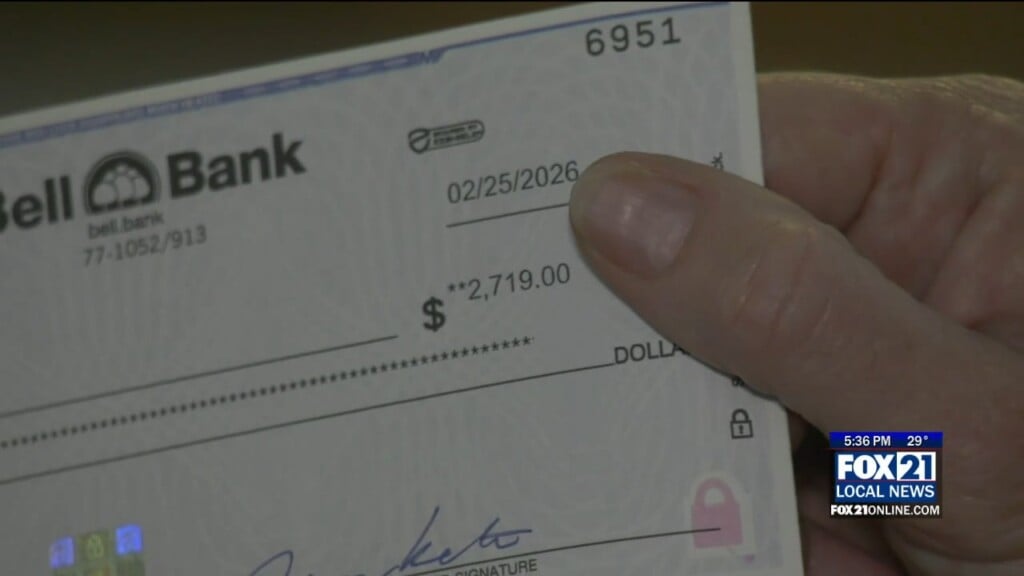

He wants to expand the Working Family Tax Credit for over 300,000 eligible households. And he recommends a one-time payment of up to $750 to about 32,400 working poor families who participate in the Minnesota Family Investment Program.

Among the tax increases, Walz’s proposal would hike the corporate tax rate by 15 percent, from the current 9.8 percent to 11.25 percent.

It would add an additional 1.5 percent tax on capital gains and dividend income of $500,000 up to $1 million, and 4 percent on income of more than $1 million. It would also tax foreign income when brought back to the U.S.

It would also expand the state’s lowest income tax bracket, which currently runs up to $27,230 for single filers or $39,810 for couples filing jointly. State budget officials did not immediately say what the upper limit would be raised to but said it amounted to an average $160 tax cut for 1 million earners.

The state’s third tax bracket would be adjusted to offset the lower-tier expansion, so individuals making $89,440 or married couples making more than $158,140 would not see any change.

The announcement sets the stage for months of debate at the Capitol. Republicans who control the Minnesota Senate have already said they won’t accept tax increases to balance the budget. Senate Majority Leader Paul Gazelka said people and businesses have already suffered enough during the pandemic. He said the state should tighten its belt and tap the state’s budget reserve instead.